Today is part 2 in a 4 part series called “Peeking Under The Hood”. It is a commentary on the FDIC’s Small Business Lending Survey released several days ago and provides some very interesting insights into small business lending across the banking industry. To catch up, you can read Part 1 here and I would advise you to download for yourself the FDIC’s report found here.

We are going to look at only two questions today. It is easy to get lost in the weeds when we talk about such heady things like “market analysis” and “competitive analysis” and retrenching around our “competitive advantage”. I think there is room in banking for those types of conversations. I think we, at all times, need to make certain that everything we do filters back to what we say we do better than anyone else in the world. That may be to serve the financial needs of Small Town, USA but we need to be the best in the world at that task and how to develop a strategy to initiate and prolong that is vital to the success/failure of community banking. Discussions on culture are uncomfortable and unnatural in an industry designed to embrace predictability and moderate pace of change, but they must be had and they must be implemented.

Other times…it’s better to distill things down to one or two basic questions that even a child can understand.

Question 1: How are we getting the business?

This is what the first part of the “Markets and Competition” section of the FDIC report sets out to answer. How are small businesses getting their loans? It seems that, regardless of size, geographic proximity has a great deal to do with access to credit. Yes, that’s right…the app is not going to be the ultimate answer and completely eliminate the need for mankind in the banking industry. We won’t have to bow to our robot overlords just yet. Businesses tend to gain access to credit at banks that are small by the FDIC’s definition (remember, less than $10B) that are close in geographic proximity. However, there is considerable data that shows technology can be used to bridge the gap between geography and small business loans. The report goes on to say, though, “small business lending remains focused substantially on areas close to bank locations, particularly for small banks” (p 21). Technology is there, but small banks are not using it.

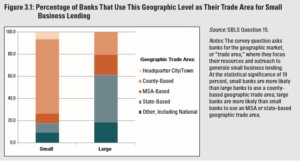

But “geography” is a broad term covering a good bit of ground (bad pun…sorry). How do we define “geography” in banking? Let’s take a look at the data.

82.3% of small banks use a geographic definition that is locally-focused…headquarter/town, county-based, or MSA-based. Fewer than 10% of small banks focus on national/state level small business lending. State-level geographic accounts for nearly 43% of big bank focus, but county-based and MSA-based make up a combined 38.8% of the geographic definition of big banks as well. 81.6% of big banks view their small business lending at a geographic level from state-level down to the county. Statistically, that’s the same number of small banks looking at small business lending on a non-national or state level. Big banks just add a statewide component to their operation. The idea that big banks only look at big, national and international businesses is a myth. There’s a great deal to be said about this and I do not really have a “one size fits all” analysis of this. Clearly, I think small banks need to look at expanding their geographic view to at least some quasi-state level approach but I do not think there’s one single simple answer here. It really depends on the market. I also think that it could really be more of a conceptual thing for smaller banks to expand their definition. First National People’s Bank and Farmer’s Trust may have served Hazard and Yoknapatawpha Counties for 150 years , so, expanding that definition may simply be the spark that lights a new way of thinking and prospecting business. (And bonus points if you can tell me the origins of those county names! No Google!)

Now, I can already hear “our loan policy says we only operate in counties contiguous…”. Ok, that’s fine. Have you considered LPO’s? Have you considered revising your loan policy? (Yes, you can. It was not passed down to you from the Lady In The Lake bestowing all power upon its wielder. Trust me.) As I said, there’s not an easy blog-friendly answer to this geographic question…but it’s one worth asking at your own bank and discussing.

Once we have an idea of where the business is, we have to discuss how to go about getting it.

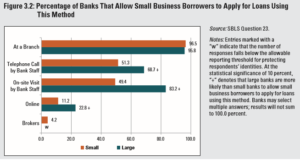

Before I get going on this graph…take a few minutes to look at it and absorb it. What speaks to you?

Here are few things that I saw that really spoke to me.

1) Big banks are not going all digital. The vast majority (and there’s not even a close second) of small business lending done by big banks is done by “staff time-intensive” methods. They are not just sending people to a website or an app and having a bot determine the creditworthiness of the business. That’s a myth we are telling ourselves that community banks are the ones that have that personal touch to banking. It may have been that way in the past, but the data does not support this today.

2) I am not 100% certain that small business lending is completely adaptable to the digital banking we’ve been told is coming. This is, admittedly, probably a controversial thing to say in a banking blog post. But if the robot overlords were going to take over small business lending, would not the bigger banks be pushing more of an online platform? It seems that the data is confirming what community banks have always been doing (and we saw was the successful model in Part 1) in assessing a more relationship based model of small business banking…one with human interaction and service. There are more profitable ways of banking small businesses outside of branches, having people call customers, and having people get in a car and go on-site to customers….but that seems to be what the large banks are doing. Clearly, there is more of a push for online applications in the big banks than in the small ones and I think that we will see more of an online push in the future in both groups of banks. But it will not eliminate the need for human-interaction in the small business market.

3) And this may be the one that gives me heartburn the greatest…look at “On-site visit by Bank Staff”. 49% of small banks vs 83.2% of large banks in this category. Now, I know that most banks allow their people to go see their customers. I have not heard of a bank that forbids their people to go to a customer’s business and if the conversation gets to where it is time to start getting application information, the loan officer is required to stop that conversation and request that it be held in the bank. I know that. But question 23 specifically says “Mark All That Apply”. Half of community banks did not consider on-site visits as even a possible means of applying for a loan. It did not even register in the minds of half of the community banks to say “yeah, our small business customers can start a loan application when our loan officers call on them”. And people wonder why I keep harping on the need to change the culture in our community banks?!!?!? It doesn’t even cross 50% of our minds to say that going out to see our customers is a method of getting business. I cannot even begin to comprehend that number. Next to branches, the big banks secondary source of loan applications are on-site visits. Community banks, if we lose the small business battle, it’s not because the big banks had better products or rates…they just understand that “service” means going to see your customers! This is not computer science or writing AI code…this is old fashioned (dare I say the dreaded “S” word) sales.

On average, large banks provide 3.5 methods of securing a loan application vs the 2.7 methods that small banks offer. That means for slightly over half of the small banks under $10B in assets, simply changing the culture to include on-site visits as a way of doing business would elevate those banks to equally competing with big banks. That is a culture change that has $0 capital expenditure to initiate. The excuse that “we can’t afford to keep up with the bigger banks” does not hold water for 50% of community banks.

Now, I am willing to concede here, that within that wide definition of small banks that the FDIC is using ($10B and below) that there is an enormous difference in sales cultures and sales processes. Some banks have calling officers and some are reliant on the loan officer who has to be a teller, CSR, debt collector, exception monitor, traffic guard, etc. I have been there. I understand. But this survey was not sent to just those individuals. It was sent to those whose responsibility is the call report (remember the original intent of this report is, partially, to understand a possible underreporting of small business lending in the call report). This means executives and/or the financial arm of the bank. That being the case, it still speaks to culture that in half of the community banks the idea of business being generated by on-site visits by bank staff is non-existent. That’s not “sales strategy” or “sales techniques”…that’s culture and that’s why Barret’s sales webinars are about culture and not some worn out sales tactic. Anyone can find a sales tactic with one quick Google search. That’s easy. Until community banks change the culture and see their loan production as part of the entrenchment around their competitive advantage, they will not grow and they will be consumed by large banks or other community banks.

4) While we all know that branching and “staff-time intensive activities” are not the most efficient, they must become so. It is time to rethink our brick-and-mortar strategy. We will have to have human interaction in the small business market, but that does not mean that we have to do it (or even need to do it) the same way we always have. Now, again, that’s a question that must be resolved bank-by-bank and market-by-market. But if branches are declining and foot traffic is declining and small business banking is important and small business banking requires staff and some level of physical interaction, we have an impasse that we must address. And it may require doing business differently than we are used to.

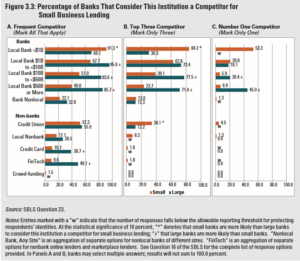

Question 2: Who are our competitors?

If your answer is “the bank down the street”, statistically speaking you are correct. Nearly 75% of small banks view a small local bank as their number one competitor. 65% of large banks view a large local bank as their number one competitor. So in a very large sense, the standard answer of “the bank down the street” is likely correct. However, there are some very interesting and insightful things that the survey brought out that merits our attention.

I think that it is very interesting that the narrower band of banks between $1B and $10B are viewed as serious competition from all angles. It’s a two front war for them. A statistically equal number of small and large banks list them as their top competitor, a significant number of both list them in their top 3, and a large number of small banks and nearly all large banks have competed against them “frequently” (however that is defined). That more narrowly defined small bank seems to be a sweet spot for small business lending as evidenced by the fact that everyone else has them on their main competitors list. If you find yourself in that band, understanding small business lending is, in my opinion, more crucial for you than for any other sized bank. Everyone else is coming after you!

Another interesting insight here is the importance of physical presence. Nearly 80% of competition for small business lending is done at the local level (ignoring the non-banks local or not). The branch will not go the way of the dodo bird for the small business market. We saw that in the first part of this analysis. The branch and the trade area is being re-thought but the physical location, nationwide, is not going away. Yes, there will be consolidation. Yes, this may result in branches being closed. However, this does not mean that small business lending will be conducted solely in the digital realm anytime soon.

I found it interesting that every big bank surveyed viewed a small bank as one of their top 3 competitors while only 62% of small banks can say the same thing about big banks. This, to me, is what I call our “blind spot”. Clearly, there are local big banks in our markets. They view small banks as a serious competitor but over a third of small banks do not reciprocate that. That’s a dangerous underestimation. Not only do big banks have the resources to offer convenience and service in a better, faster, more efficient manner…they are actively saying “small banks are on our radar”. That is a blind spot, community banks!!!

As for the non-banks, I think it is very interesting that FinTech is so highly weighted with large banks and credit unions are the non-bank competitor for small banks. I think that is a blind spot for both big and small banks. How many of our small bank customers use Venmo or PayPal on a daily basis? How many large bank customers live in areas served by a credit union? This is an area that can slip up and bite both large and small banks.

Conclusion…finally

As we continue to peek under the hood of small business lending, we should be a little bit scared of what we are seeing. It is my belief that this is not a battle of the haves and the have-nots. The data indicates that large banks are more proactive in their attacking the small business market than small banks are. As I have said many times, this is not about rates and flashy toys. This is about shifting the culture back to doing what small banks do best…servicing the local communities and this means a hard look at what small banks are doing in the small business market. This requires some changes. This requires some hard conversations with executive management, the board, and the employees about what can be done. This requires seeing the blind spots for what they are…chinks in the armor. They may not have been exploited yet…but why would small banks even leave the opportunity available to competition?

Check back tomorrow…same bank time, same bank channel…for Part 3 “What Are You Doing and What Is Your Competition Doing?”

Byron

“Peeking Under The Hood”: Markets and Competition. Part 2 of 4

Share...

Facebook

Twitter

LinkedIn

Email

written by

Byron

Byron Earnheart is the Programming Director for the Barret School of Banking in Memphis, TN and the host of the “Main Street

Banking” podcast…the only podcast solely devoted to community banks. He has over 15 years experience in the financial

services industry; 11 of which have been in banking in various roles from teller work to branch management. He spends his time

playing guitar and singing in Delta Heart (the “house band of the Mississippi Delta”), writing music, cooking, reading, and

enduring the University of Tennessee Volunteers athletic seasons. He is married to his wife Kelly of 11 years and has two

children, John Aubrey (11) and Mary Laura (7).

If you'd like to hear Byron's music, check him out on Spotify: