Today, we are wrapping up our series analyzing the FDIC’s Small Business Lending Survey from the community bank perspective. I must say that I have enjoyed this but it has taken me (and hopefully you as well) into directions that were not planned. I can’t say that I walked into this analysis with any expectations, but I can say that I was not expecting to find such fundamental aspects of relationship management to be in the forefront. I guess the old adage “there’s nothing new under the sun” is more true than I had realized. That being the case, it helps for us to go back and remember those fundamental concepts we have learned or just labeled “common sense”. That’s why I harp on these things so much. One of my favorite business quotes comes from John Maynard Keynes and it talks about how bankers wind up being the biggest romantics among the people. I hate the idea of a romantic idea like community banking being squashed because we forgot the basics.

If you’re just joining us, catch up on Part 1, Part 2, Part 3, and the FDIC Small Business Survey.

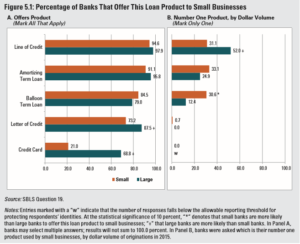

So with all of that, we come to the end…products and underwriting. Guess what…we all offer most of the same loan products! Lines of credit, amortizing term loans, and balloon loans dominate both small and large banks product offerings.

What I did find interesting on this graph was, in terms of dollar volume, small banks have nearly an equal distribution across all three types of credit products. That’s informative to me because it shows that with our leadership in valuing relationships, we are equally as likely to recommend one product over another in terms of credit. Larger banks have tendency to lend more lines of credit. The survey does not offer an explanation of this but I think it has a great deal to do with staff. I do not think that revolving lines are superior to amortized loans. They are just products with a particular purpose. But it does not take a community banker long to know that, many times, we do not have the staff to monitor lines the way they really need to be monitored. I do not have any hard data to back that up. That is just my educated guess.

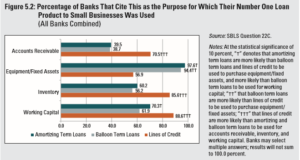

I hesitate to even use this next graphic because it seems pedantic to bring this up and spend time talking about it…but there is a point here.

Shorter-term borrowing needs are financed by shorter-termed loan products and longer-term needs are financed with longer-term loan products across all sizes of banks. In other news, water is also wet and the sky is blue.

The reason I am even talking about this observation (that is brought to you by Captain Obvious) is that both small and large banks offer the same products (with the exception of credit cards as those really are more in the wheelhouse of big banks due to risk mitigation capabilities…more on that later). We use these products for the same purposes. This further illustrates my point that the difference between big and small banks is not product. It is strategy. The difference is how we deploy those products across our trade areas and how we tell our customers about them and get their business. Yes, there are some differences in pricing but we saw yesterday that pricing is never a top advantage either bank utilizes against the other. It comes up a great deal to be certain. It is the quick go-to answer at a cocktail party about big vs small banks. But the data does not confirm that. We use the same products for the same reasons in the same marketplace. The only difference that can exist is how we use them and how we market that.

Finally, let’s take a look at underwriting and *gulp* exceptions.

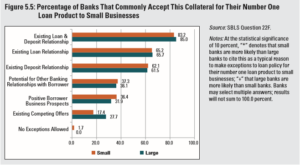

**NOTE** Figure 5.5 is clearly a typo within the survey. It has the same title as Fig. 5.4 which deals with collateral though the graph and the analysis accompanying 5.5 deal with exceptions. However, as I am directly quoting from the survey, I do not feel right in editing anything that I quote and would rather attach this disclaimer.

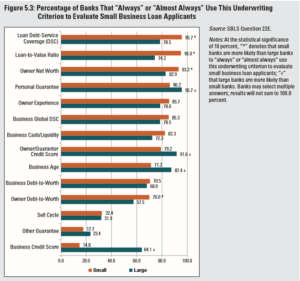

What we see is that small banks are more likely to use more traditional loan/owner characteristics, loan DSC and global DSC, LTV, owner net worth, and owner debt-to-worth than large banks. Clearly, large bank small business bankers did not come to Barret’s Commercial Lending Academy or come to the Grad School for Financial Statements and Commercial Lending classes! Both are taught by Richard Hamm and these facets of lending are…strongly encouraged. Large banks, statistically speaking, use more frequently guarantees, owner’s credit score, business age, and business credit score. The latter is used at a much higher rate than small banks. There are pros and cons to that and that is a different discussion for another day. Now before we community bankers start laughing at our foolish large bank brethren, we need to remember that they have a larger balance sheet over which to mitigate risk and, given that perspective, a more quantitative underwriting process is probably more appropriate in that context to say nothing of efficient…in theory. That would absolutely freak me out if I were a credit officer, but I do see some of logic there.

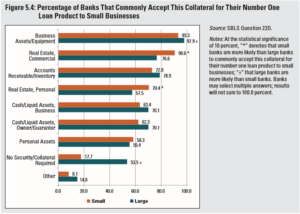

We continue to see some differences in the types of collateral accepted by both sizes of banks. Small banks are more inclined to accept either personal or business real estate. Larger banks are more inclined to go unsecured on their debt. Really. Again, I think that goes back to their risk management is going to be a different animal as compared to community banks. At worst, they are going to have the resources to go deeper through the courts to sue against a guarantee and I have to think that the time/cost of repossessing collateral, to them, has less of an appeal than to community banks. That being said, I am not 100% sold on that as an explanation. The use of real estate, too, is telling. We know that physical proximity is key to the small business market and, in my opinion, small banks’ use of real estate as collateral is a positive.

I also find it interesting that both size banks make similar exceptions to loan policy as we see in Figure 5.5 (despite what the title of the chart says. Please see the note). Both banks seem to have the same amount of flexibility when it comes to those not-quite-textbook credits even though they have different “textbooks” so to speak. Community banks cannot say, however, that we are more flexible. Big banks may execute their flexibility differently, but, in the right context they will work with the borrower and document the same policy exceptions that small banks do.

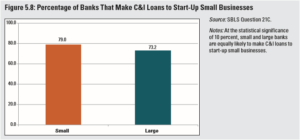

Finally, the last point I would like to bring up in this section is the lending to start-up businesses. Here, start-ups are defined as being open for less than two years.

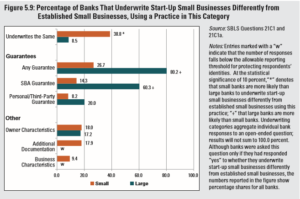

Both sized banks at about the same rate say they are willing to loan to start ups even though, as we have seen, both banks will approach the credit differently. Note, too, the key word here is “willing”. “Willing” does not necessarily lead to funded loan volume. But what I find compelling, in terms of lending to start-ups, is in Figure 5.9. This breaks down how both sets of banks look at start-ups. For over a third of small banks, we underwrite them the same as any other credit. That makes sense as we rely on hard assets, DSC particularly from a global perspective, the net worth of the owner. In a very real sense, this offsets the business risk of start-ups. Larger banks, too, seek to mitigate the business risk here through strong guarantees including SBA guarantees. Here, too, is another striking factor. 60% of large banks look at SBA guarantees while only 14% of small banks do the same. Now, I hear the mob already saying the usual “SBA guarantees are worthless! I had one go south on me back in 19XX blah blah blah…” and that’s fair. But if a significant portion of large banks are using them and they still account for a large portion of lending (check your investment account and see if you don’t own some SBA backed securities if you don’t believe me!), isn’t it likely that you might be painting this with a broad brush and leaving some money on the table? In shifting your culture, it might be time to talk with someone who does SBA lending for banks.

So, to wrap up today’s analysis, the biggest takeaway I see here is really more on a corporate level. Big banks and small banks could probably learn something from each other in how they approach the small business market. We have the same products. We are using those products for the same business purpose for our customers but we have a different way to approach them. If physical presence and being “involved with the community” truly is part of the large banks’ strategy as we have seen over the past few days, it probably wouldn’t hurt for them to use this information to see how community banks are approaching small business lending from an underwriting perspective. If community banks are going to compete with larger banks, it probably wouldn’t hurt to understand the underwriting practices of larger banks in order to be more competitive and flexible. I am not advocating that we should start piling up unsecured debt on the books (just…no!), but I am saying that maybe a more objective look at things like using SBA guarantees might have a place in the toolbox.

Well, we have come to the end of our time “under the hood” of small business banking in America. I learned a great deal by doing this and it will shape how and what we present here at Barret…hopefully for the better! I hope that you have as well. I hope that you have seen that differences between the community bank and the large bank is really more simply understood than what, I feel, we’ve been led to believe. Unfortunately, any issues that we’ve discussed here or that you have seen within your own bank’s operations, strategy, and competitive initiatives are not going to be resolved by something easy like “get in your car and make 10 on-site calls on your customers in the next two weeks”. In order to grow and protect the advantages community banks have in the small business market, we are going to have to rethink some things…from our culture to our strategies to how we think about our branches to even rethinking our trade areas. It won’t be easy. It won’t be comfortable and you might not even think it has merit pursuant to your bank’s philosophy. But it’s clear to me by looking at these numbers and thinking about what big banks are doing (as we discussed in our blog post here), big banks are thinking this way and they see an opportunity in which they can take business away from community banks by doing business the way we say we do business. For them, it may not be executed perfectly or immediately for your market, but at some point, it will happen. They will be doing business the way we say we do business and doing it better unless we circle back to what makes us…us.

Thanks for spending these past 4 days with us! We’ve got some excellent material coming out that speaks directly to the points we’ve brought out here so stay plugged in to Barret through the newsletter and our social media.

Byron

“Peeking Under the Hood:” Loan Products and Underwriting. Part 4 of 4

Share...

Facebook

Twitter

LinkedIn

Email

written by

Byron

Byron Earnheart is the Programming Director for the Barret School of Banking in Memphis, TN and the host of the “Main Street

Banking” podcast…the only podcast solely devoted to community banks. He has over 15 years experience in the financial

services industry; 11 of which have been in banking in various roles from teller work to branch management. He spends his time

playing guitar and singing in Delta Heart (the “house band of the Mississippi Delta”), writing music, cooking, reading, and

enduring the University of Tennessee Volunteers athletic seasons. He is married to his wife Kelly of 11 years and has two

children, John Aubrey (11) and Mary Laura (7).

If you'd like to hear Byron's music, check him out on Spotify: