Today, I’m starting a new blog series entitled “Peeking Under The Hood” where we will look at the FDIC’s Small Business Lending Survey released a few days ago. You can find a link to it here.

Now, I know spending four days in an FDIC report is right up there with watching paint dry, the grass grow, and the Tennessee Volunteer football program. Trust me. I get that. But I think this report has more insight in it than we realize. Banks love small businesses. They are the backbone to the economy. We love working with those diligent and dedicated entrepreneurs and helping them grow. We love seeing our communities transformed into viable economic centers picking themselves up by their own bootstraps and daring to take on the world. We also love the fact that small businesses can nearly double our household penetration numbers in terms of walletshare. The owners have personal and business accounts, there are personal and business loans, they have personal and business credit cards, there are separate digital products, there are various trust/investment options we can present, not to mention all the Workforce Banking opportunities, etc. I mean, let’s be honest here too. Small businesses are gold mines for our bottom line to say nothing of our reputation and branding.

So, when we get the opportunity to “peek under the hood” and see how small business lending is being conducted across our industry, it merits some of our time. That’s what the FDIC has done here. In an effort to a) understand why the call report numbers seem off in terms of small business lending and b) to understand small business lending as branch’s decline and access to small business credit, theoretically, decreases (it won’t…but we all know that “access to credit” is a big deal with regulators) the FDIC looked at the numbers and then received survey responses from 1200 banks about their small business lending practices over the course of 2016-2017. Talk about competitive intelligence!!! Most banks can’t afford this type of competitive information about any aspect of their business much less something as crucial as small business lending!!!

Over the next 4 days, I am going to be breaking down Sections 2-5 of the report in terms of understanding the implications for community banks. Think of this as the “Commentary” section similar to those special features on your favorite Blu-Ray. I am leaving out the Executive Summary and Section 1 as the Summary is just that…a summary and not much detail and Section 1 talks about the need to understand the possibility of underreporting small business lending from the call reports. I’m a finance geek…and even that bores me. Making sure the call reports are not underreported is important, but hardly relevant to the community bank in their day-to-day.

Here’s the schedule of topics:

Today: Defining small business lending

Wednesday: What is your market and who is your competition?

Thursday: What are you doing and what is your competition doing?

Friday: Products and Practices

I should also note that the FDIC report notes the difference between “big” and “small” banks at the $10 billion level. It should go without saying that there is a world of difference between the scope and reach of a $9.9 billion bank and a $250 million bank. I am not discounting that. There are, however, fundamental principles that can still be brought out of this report for any sized bank. I will, however, use the FDIC’s definition only to keep the analysis in line with the report. So, no comments about the wide definition!

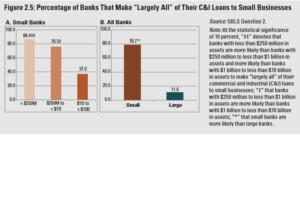

In short, for the small bank, the best proxy determined by the FDIC to measure small business lending is the bank’s C&I numbers. This tends to get approximately 80% of the small business loans while the bank, in order to get a true number, may want to look at adding those commercial purpose 1-4 real estate loans as well as those that do not fit the C&I limits for the call report. It really depends on how the bank (regardless of size) looks at their small business customers. Here is where it gets to the interesting information.

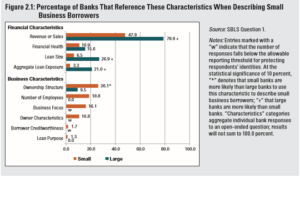

Look at the differences between how small banks reference (read this as “view”) their small business customers. Small banks take a much broader view of their relationships and one that is much more in line with the needs of the community. There is a deeper understanding of what the business really is, who is running that business, that business’ focus (how it is serving the community), etc. That’s a win for community banks! That’s validation of what we say is our competitive advantage. For the small business owner, we truly are the banks that know you and know your business. We look at the credit the way you would want your business looked at. (As the son of a special asset guru and grizzled old banker, I will note that the noticeable lack of attention put on Aggregate Loan Exposure is a bit troubling. Anecdotally, I think we are so happy to write up a promissory note for one of our good customers that we sometimes forget how deep we are into the relationship. We should remember always that we are risk managers and not investors. That’s one of the biggest takeaways I’ve ever received from my banking training. Please start considering Loan Exposure to your credit analysis!)

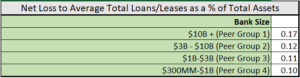

Also, I would say that the community banking approach is working. Below is a table showing the Net Loss to Avg Total Lns/Leases expressed as a % of Total Assets as of 12/31/17 (the end of this survey).

Now, I am not certain that this metric is the best possible view of credit quality within the small business lending portfolio. That data is outside of my paygrade to handle…but…it does show that, at the $10B mark, there’s a definite increase in loan loss showing that the smaller banks are doing something right in terms of credit underwriting. I really like what the report says on page 13 about small banks having an “informational advantage in small business lending”. Because smaller banks are so broad in their analysis, we get a whole picture of the borrower and are able to move and adapt our strategies in order to meet the customer’s need.

But, if you’ve read this blog long enough…I bet you know where this is going.

Figure 2.5 from the FDIC report breaks down the assertion that small banks should use the C&I number as their proxy for small business lending. Now, couple the improved credit quality of “relationship based lending”, the deep penetration of walletshare small business lending offers, the “informational advantage” small banks enjoy over big banks in small business lending, the previous blog post about JP Morgan Chase’s strategic plan to be more client centric and their data gathering capabilities, and that MASSIVE gap in section B of the above chart and what do you have? A massive blind spot in one of community banking’ competitive advantages in the small business market. Remember, this data is old. It is backwards looking. This is how small business lending operated 10 months ago. Even the government admitted community banking enjoyed an “informational advantage” in small business lending and shows this massive difference in community banking’s emphasis on small business lending vs the big banks. However, once we turn around and look forward…it WILL NOT always be thus!

Community banks have done an excellent job in providing credit for small businesses. It will likely continue to do so, but it will not continue to do so without circling around our competitive advantage of relationship lending and exploiting our “informational advantage”. Community banks cannot win the war based flashy toys and rates…but we can win the war by doing what we do best even if that means doing it in different ways. Tactics won’t win the war…strategy will win the war. We need to be having the discussion about protecting this advantage and circling around our customers because, as we will see soon, physical market presence is no longer a key concern. Just because the big banks don’t have a branch in your area, does not mean they aren’t a threat to your best customers.

Come back tomorrow for Part 2 of Peeking Under the Hood!

Byron

"Peeking Under The Hood: A look at small business lending. Part 1 of 4

Share...

Facebook

Twitter

LinkedIn

Email

written by

Byron

Byron Earnheart is the Programming Director for the Barret School of Banking in Memphis, TN and the host of the “Main Street

Banking” podcast…the only podcast solely devoted to community banks. He has over 15 years experience in the financial

services industry; 11 of which have been in banking in various roles from teller work to branch management. He spends his time

playing guitar and singing in Delta Heart (the “house band of the Mississippi Delta”), writing music, cooking, reading, and

enduring the University of Tennessee Volunteers athletic seasons. He is married to his wife Kelly of 11 years and has two

children, John Aubrey (11) and Mary Laura (7).

If you'd like to hear Byron's music, check him out on Spotify: