Did you know…?

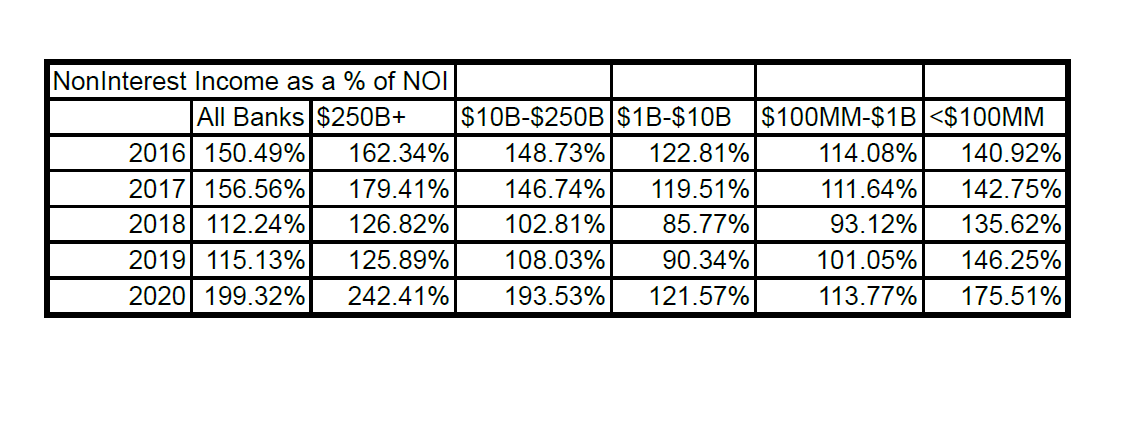

In doing some research around community banks, NSF fees, and the probable regulations that are coming down from Washington around those, I realized that banks’ performance is heavily addicted to Non-Interest Income. Big time. Over the past 5 years, regardless of bank size (and really as far back as the FDIC database will let me look!), Non-Interest Income has represented a substantial multiple of Net Operating Income! The numbers in the chart above are somewhat representative of the normal course of doing business as a bank from the early 90’s until today. Again, the FDIC’s database only went back so far.

If you consider this from the standpoint of the efficiency ratio (and y’all know me…I always look at banking from that perspective!), what this means is that without Non-Interest Income, banking, at any sized institution, is an unprofitable business model. Without the Non-Interest Income addition, our efficiency ratios would be significantly greater than 100% (meaning a negative net income) most years and across most asset classes. Non-Interest Expense (largely our personnel expenses) are significantly higher than our Net Interest Income and, therefore, without Non-Interest Income we could not operate under the same model we do today.

Considering this, we cannot solely lend or invest our way into profitability. There is no way to position the balance sheet (realistically) to gain profitability without non-interest income. That applies to every grouping of banks by asset size.

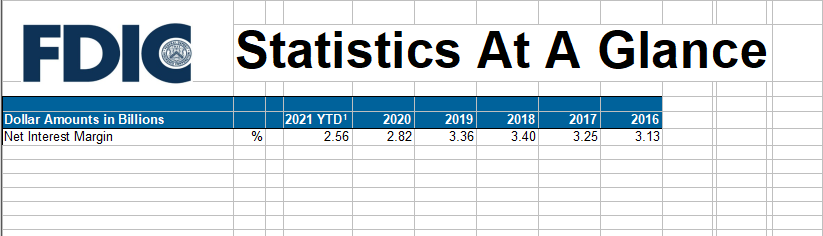

This is particularly concerning when we consider declining Net Interest Margins.

“Ok, number geek! What does all of this mean in English?”

After we pay our people and overhead, pay our depositors, and make loans we are still not earning money or at best, not much money. This is likely not news to some of you, however, for others it is likely a different way to think about your bank.

“So, are you really claiming that interest rates and balance sheet management aren’t important in banking?!?”

Nope. Not at all. I jokingly teach in my banking classes Byron’s First Law of Finance: Money is a commodity…an interest rate is the price of that commodity…and banks are the retailers of that commodity. In following Byron’s First Law of Finance, we cannot ignore rates. However, we cannot ignore the other side of our revenue either and that leads me to the question…

Does your bank spend more time discussing rates or more time discussing Non-Interest Income?

It’s a little bit of a startling question, I admit. In truth, we should be discussing all aspects of the efficiency ratio. There are several ways to boost our profitability and impact multiple areas of efficiency simultaneously…i.e. kill two birds with one stone. However, with multiples like 140% of Net Operating Income, we have to ask ourselves are we devoting enough energy to this segment?!

And like most things in banking that I talk about, it is not something I am going to sit down and say “Follow these steps to ultimate profitability!”. I don’t know your market…you do. However, given the data and the nature of the banking business model, it stands to reason that maximizing non-interest income should a part of your strategic plan.

So, with apologies to Robert Palmer…I think we “might as well face it, we’re addicted to” non-interest income.